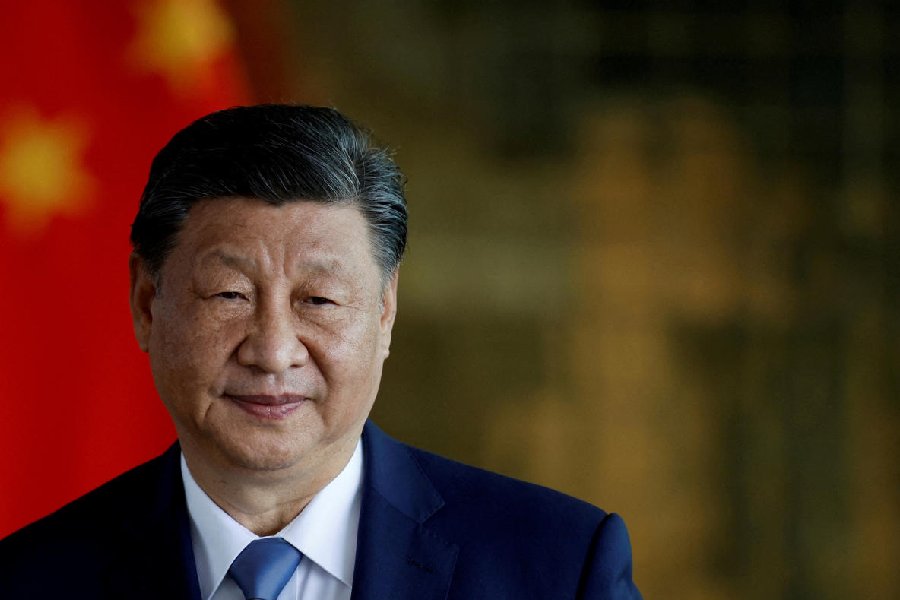

The Xi Jinping regime in China is actively pursuing a two-pronged strategy — boosting domestic consumption and trying to reverse foreign investment outflows — to minimise the possibility of the country’s growth target of 5 per cent getting affected by US President Donald Trump’s tariff war on Beijing.

On Sunday, the Chinese government and the Communist Party jointly rolled out a roadmap, according to a New York Times report, for economic stimulus — including larger pensions, better medical benefits and higher wages — to bolster China’s lagging domestic consumption, a major cause of worry for policy makers at a time the country is witnessing a deflationary spiral.

Efforts to jump-start domestic economy by unlocking demand was complemented by an attempt to reach out to foreign investors as Bloomberg reported the possibility of Global CEOs — including Qualcomm’s Cristiano Amon and Saudi Aramco’s Amin Nasser — travelling to Beijing for an annual gathering of top executives and some of them meeting Xi Jinping and other top leaders.

While the impact of the twin moves can be gauged only after a few months, there is little doubt that the policymakers in Beijing are going all out to ensure that the economy’s growth momentum doesn’t get affected due to the uncertainties crowding global trade.

The New York Times report mentioned that China’s leaders are searching for ways to rebalance the economy away from its dependence on an ever-rising trade surplus — a fall out of its stellar show in exports — that reached almost $1 trillion last year.

Not only has Trump imposed 20 per cent tariffs on China’s shipments to the United States, countries in Europe, Latin America, Africa and in the Gulf are also raising tariffs on China’s expansive manufactured-goods exports. Recently, Indian commerce minister Piyush Goyal suggested industry looks for options beyond China for their imports.

The “Special Action Plan to Boost Consumption” was issued in the name of two of the highest organs of power in China — the General Office of the Cabinet and the General Office of the Central Committee of the Communist Party, reported New York Times, before adding that the unusual step was an attempt to signal that the Chinese leaders are serious about addressing lacklustre domestic spending. More announcements on the plan are expected over the next few days.

A housing market crash in the past three years wiped out much of the savings of the households, who responded by curtailing their spending on hotels, restaurants and other services and putting their savings into bank accounts, despite earning very little interest.

Against this backdrop, the proposed move — to be largely implemented by the local governments — includes many details that could prove popular with the Chinese public if implemented as it outlines plans to issue payments or increase subsidies to “people in need” and increase retirees’ pension benefits. It also directed local governments to pay their overdue debts to businesses.

While the stimulus package has been welcomed by economists, there are concerns as a large number of local governments are struggling under enormous debts and plummeting revenues from a decline in the sale of land, one of their main sources of income.

Amid concerns that the stimulus package — being backed by the highest ever deficit (about $780 billion) in the annual budget for over three decades —may not be enough, the government is trying to send out a message that the country is open for business.

Contrasting itself with Trump’s more protectionist “America First” policies, Beijing is trying to cast itself as a supporter of private enterprise, reported Bloomberg, referring to Xi’s high-profile meeting with entrepreneurs like Alibaba Group Holding co-founder Jack Ma in February.

While the stock markets in China have been a bright spot in recent months drawing portfolio investments from across the globe, there are concerns over flow of foreign direct investment. That explains the buzz about the possible meeting between Xi and some global CEOs on March 28, according to a Bloomberg report, when they arrive in Beijing to attend the China Development Forum.

Blackstone’s Steve Schwarzman, Pfizer’s Albert Bourla and FedEx Corp’s Rajesh Subramaniam are expected to attend again this year, said the Bloomberg report quoting sources.