The Securities and Exchange Board of India (Sebi) is considering a proposal from the Calcutta Stock Exchange for voluntary exit as a stock exchange, minister of state for finance Pankaj Chaudhary told the Rajya Sabha on Tuesday, potentially ringing a curtain call on what was once the largest bourse of India.

CSE, where trading has been suspended from 2013 due to non-compliance with Sebi’s regulatory requirements, has been contesting the market regulator’s diktat to shut down the exchange in courts.

Sebi had initiated compulsory exit proceedings against the exchange in May 2015. In response, CSE filed writ petitions before the Calcutta High Court challenging the regulator’s action.

After prolonged litigation, in an order dated February 19, 2024, the HC granted CSE six months to either establish a clearing corporation or tie up with an existing one, in compliance with the Securities Contracts (Regulation) (Stock Exchanges and Clearing Corporations) Regulations, 2018, failing which Sebi would be free to proceed by law. CSE management did not appeal against the order in the Supreme Court.

“On February 18, 2025, CSE submitted a proposal for voluntary exit as a stock exchange under the Sebi-prescribed Exit Policy for Stock Exchanges. The proposal is currently under examination by SEBI,” minister Chaudhary said in response to a question by Samik Bhattacharya, RS member and the newly appointed state president of BJP in Bengal.

Sources in CSE said the exchange has proposed that it should be allowed to sell the EM Bypass land parcel, for which it has received a bid of ₹253 crore from Srijan Realty, to create a corpus to set up a clearing corporation, as mandated by Sebi, which will require an investment of ₹300 crore. “It is not sealed, signed and delivered, as far as closure is concerned,” a source privy to the matter said, pointing out that Sebi is yet to come up with its decision on CSE’s proposal.

However, the tide against the survival of CSE appears to be strong, as it is the only significant regional stock exchange to remain apart from the Metropolitan Stock Exchange of India Ltd in Mumbai. While the final decision rests with Sebi, the request underscores the shifting landscape of Indian finance, where regional bourses have struggled to adapt to a rapidly modernising and centralising market ecosystem.

Officials lamented that the exchange lacked the political heft required to exist. “None of the political parties appear to be ready to take up the cause. There is not much enthusiasm from the stakeholders either,” they said.

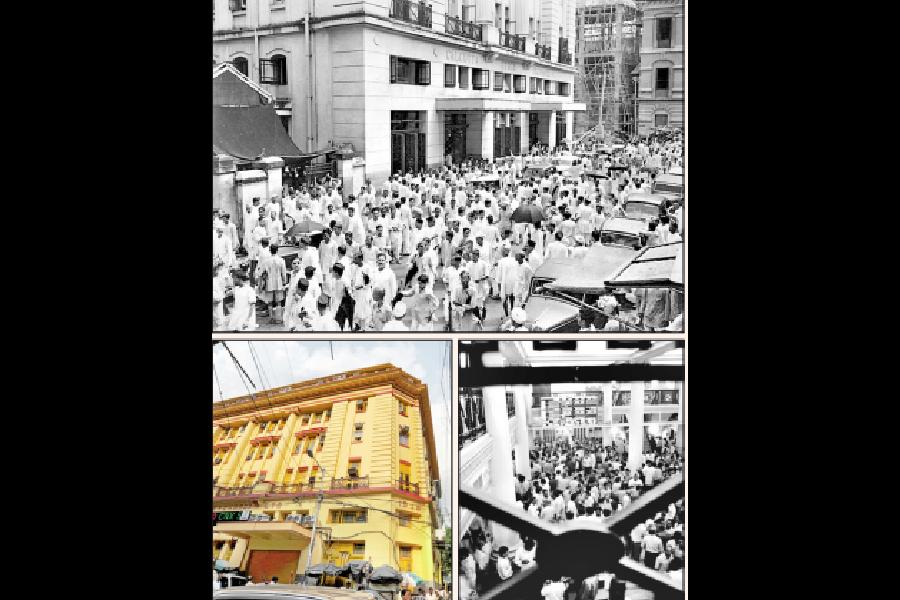

CSE, which was incorporated in 1908 with 150 members, still has over 1,250 companies listed with it, including behemoths such as ITC. Before the payment crisis which rang the death knell of CSE in 2000, the exchange used to have a higher trading volume than even BSE on days.