The RBI decision to extend the last tranche of its capital conservation buffer by one year is a positive for the Centre as it will now have to infuse relatively lower capital into state-run banks in this fiscal.

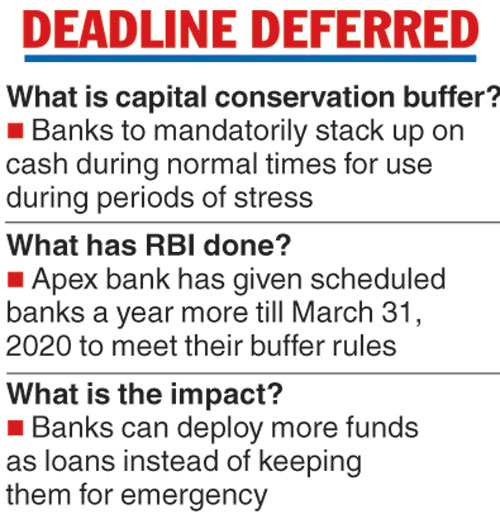

In a meeting on Monday, the central board of the RBI decided to retain the capital-to-risk-weighted assets (CRAR), or the ratio of bank’s capital to its assets, at 9 per cent. However, it agreed to extend the transition period to implement the last tranche of 0.625 per cent of capital buffer by one year to March 31, 2020.

According to Basel III norms, being implemented in phases (it was earlier scheduled to be fully implemented by March 2019) by the RBI, banks have to maintain a capital conservation buffer.

CCB is designed to ensure that the lenders build up capital buffers during normal times (outside periods of stress) which can be drawn down if losses are suffered during a stressed period.

According to earlier RBI norms, banks had to build CCB of 1.875 per cent of their risk-weighted assets — or the capital that banks have to be set aside according to the asset’s riskiness — by March 31, 2018.

This was set to go up to 2.5 per cent by March next year. Monday’s decision means that banks will not have to maintain this additional 0.625 per cent by March 2019.

The Telegraph

There are few PSU banks that are below the minimum threshold requirements set by the RBI, thereby necessitating capital infusion from the central government. Brokerages feel that due to the RBI decision, the recap burden on the Centre will be relatively lower, though any benefit will only be of a small nature.

“As a result of this decision, the total CET 1 requirement as of March 2019 would continue to be 7.375 per cent. Assuming the CET1 ratios and risk-weighted assets (RWA) as of the second quarter 2018-19, the implied lower capital infusion would be Rs 13,390 crore. While this would lessen the government’s burden, we believe this is miniscule and would only meet the minimum requirements. Additional capital infusion would be required should the government want the banks to push balance sheet growth,’’ analysts at Jefferies said in a report. CET1 is the minimum capital needed and it stands at 5.5 per cent of the assets.

Echoing a similar view, a note from Edelweiss Securities said that the measures will only provide some temporary relief to PSU banks.

Reserves level

The RBI board will soon set up a high-level committee to examine the Economic Capital Framework (ECF) to determine the appropriate levels of reserves the central bank should hold, official sources said on Tuesday.

After a day-long meeting on Monday, the central board of the RBI decided to set up an expert committee to look into ECF. It was also agreed that the membership and terms of reference of the panel will be jointly determined by the government and the Reserve Bank of India.