The Union budget may not have enthused those scouting for big ideas but the emphasis on growth through higher capital expenditure, coupled with the absence of any harsh fiscal consolidation steps and populist measures, received a thumbs-up from the investment community.

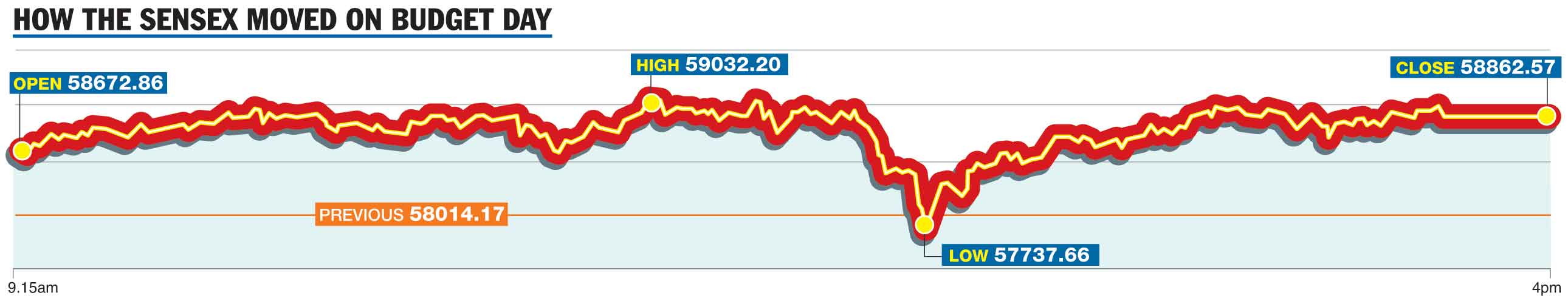

The cheering saw the benchmark indices closing firmly in the green after slipping briefly during the day. The 30-share Sensex finished with gains of 848.40 points or 1.46 per cent at 58,862.57 and the broader Nifty settled 237 points higher at 17,576.85.

In her budget proposals, finance minister Nirmala Sitharaman did not announce any major relief in direct taxes for salaried individuals that would have pushed up consumption. But she proposed a strong 35 per cent rise in capital expenditure, which analysts said would have a multiplier effect on various industries.

They added that the absence of any negative proposals like a hike in the long-term capital gains tax or wealth tax to push up revenues also came as a relief to the markets, particularly at a time inflation concerns have forced policy makers to tighten liquidity taps or raise interest rates.

Moreover, the absence of any populist move ahead of the elections in the five states led to the view that the budget was a prudent exercise, given the current conditions.

According to Aditya Shah, CIO, JST Investments, an important takeaway, apart from the 35.4 per cent rise in capital expenditure to Rs 7.50 lakh crore in 2022-23, was that the 15 per cent lower tax rate for manufacturing units was extended for one more year till March 2024.

“The budget is well balanced…. (It) pushes ahead with the development agenda of the government. There was little tinkering with the tax structure as majority of the changes have been made in the previous years and the government had little scope to make any changes…. All in all, a stable budget. Nothing to complain about,” he added.

The Sensex opened firmly at 58,672.86 and breached 59,000 during intra-day trading to touch a high of 59,032.20. Although it came under pressure briefly after the budget speech to a hit a low of 57,737.66, the stocks regained their composure soon and ended on an encouraging note at 58,862.57.

Tata Steel led the gainers’ list, rising 7.57 per cent, and it was followed by Sun Pharma, IndusInd Bank, L&T, UltraCement and ITC among others, which rose up to 6.94 per cent.

Sandeep Bhardwaj, CEO, Retail, IIFL Securities, felt that the increase in capital expenditure would not only have a positive rub-off on the economy, but also on the stock markets.

“The 35 per cent increase is much above expectations and is likely to accelerate economic growth and job creation, supported by reasonable growth in exports, higher-than-expected tax collections and multiple support sops for SMEs and small entrepreneurs. The corporate earnings are likely to surprise positively in the coming quarters and attract a relatively higher foreign capital allocation in the emerging basket. Indian markets will likely get re-rated,” he added.

With a key event now out of the way, the focus will now shift to the upcoming meet of the monetary policy committee. The interest-rate-setting body will begin a three-day meeting on February 6, and its policy announcements are being keenly watched, given the hawkish stand taken by other central banks.

Some analysts feel that the RBI may raise the reverse repo rate in a major policy normalisation step and that it may follow up with a repo rate hike later this calendar year.

“Any sudden and sharp fiscal consolidation steps announced could have throttled the nascent and uneven recovery of the Indian economy. A 6.9 per cent fiscal deficit target alleviates that pain. The budget has focused on boosting overall demand, though, and has invested more in infrastructure… we are in a high- growth, high-inflation environment. The budget is behind us and now February 9 becomes relevant,” Motilal Oswal, MD & CEO, Motilal Oswal Financial Services, said.

Oswal is of the view that the Nifty is likely to hit 20,000 while it would be 65,000 for the Sensex by December 2022 on the back of a 15-20 per cent earnings growth in 2022-23. He, however, cautioned that this journey is likely to be volatile.

Moreover, the absence of any populist move ahead of the elections in the five states led to the view that the budget was a prudent exercise, given the current conditions.

According to Aditya Shah, CIO, JST Investments, an important takeaway, apart from the 35.4 per cent rise in capital expenditure to Rs 7.50 lakh crore in 2022-23, was that the 15 per cent lower tax rate for manufacturing units was extended for one more year till March 2024.

“The budget is well balanced…. (It) pushes on with the development agenda of the government. There was little tinkering with the tax structure as majority of the changes have been made in the previous years and the government had little scope to make any changes…. All in all, a stable budget. Nothing to complain about,” he added.

The Sensex opened firmly at 58,672.86 and breached 59,000 during intra-day trading to touch a high of 59,032.20. Although it came under pressure briefly after the budget speech to a hit a low of 57,737.66, the stocks regained their composure soon and ended on an encouraging note at 58,862.57.

Tata Steel led the gainers’ list, rising 7.57 per cent, and it was followed by Sun Pharma, IndusInd Bank, L&T, UltraCement and ITC among others, which rose up to 6.94 per cent.

Sandeep Bhardwaj, CEO, Retail, IIFL Securities, felt that the increase in capital expenditure would not only have a positive rub-off on the economy, but also on the stock markets.

“The 35 per cent increase is much above expectations and is likely to accelerate economic growth and job creation, supported by reasonable growth in exports, higher-than-expected tax collections and multiple support sops for SMEs and small entrepreneurs. The corporate earnings are likely to surprise positively in the coming quarters and attract a relatively higher foreign capital allocation in the emerging basket. Indian markets will likely get re-rated,” he added.

With a key event now out of the way, the focus will now shift to the upcoming meet of the monetary policy committee. The interest-rate-setting body will begin a three-day meeting on February 6, and its policy announcements are being keenly watched, given the hawkish stand taken by other central banks.

“Any sudden and sharp fiscal consolidation steps announced could have throttled the nascent and uneven recovery of the Indian economy. A 6.9 per cent fiscal deficit target alleviates that pain. The budget has focused on boosting overall demand, though, and has invested more in infrastructure… we are in a high- growth, high-inflation environment,” Motilal Oswal, MD & CEO, Motilal Oswal Financial Services, said.