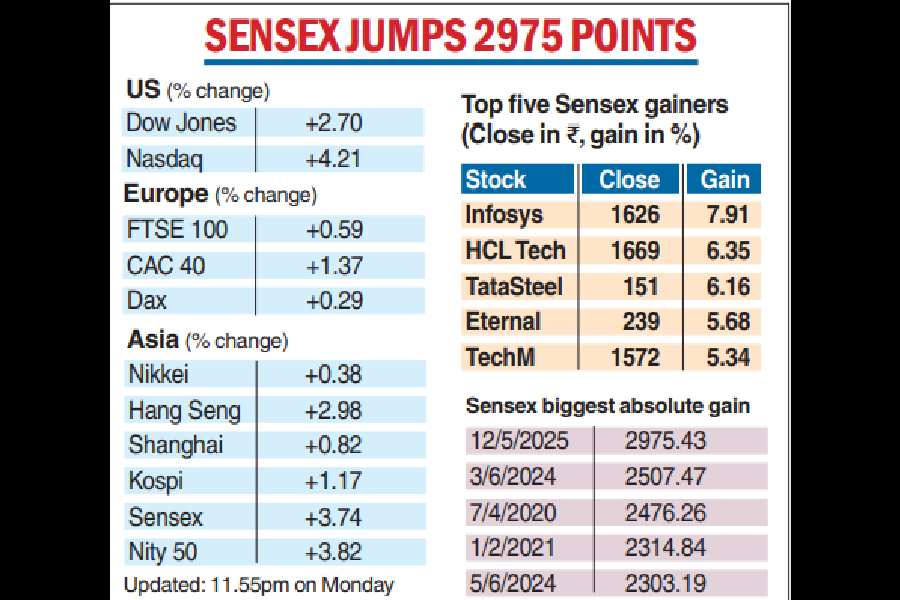

Benchmark stock indices Sensex and Nifty recorded their biggest single-day gains in absolute terms on Monday, both rising by nearly 4 per cent. The bullish momentum was fueled by an understanding between India and Pakistan to halt military actions, coupled with a US-China pact to slash tariffs — sending investor confidence into an overdrive and markets into an euphoric upswing.

The 30-share BSE Sensex soared 2975.43 points, or 3.74 per cent, to settle at a more than seven-month high of 82429.90. In intraday trade, the benchmark rallied 3041.5 points, or 3.82 per cent, to a high of 82,495.97.

The 50-share NSE Nifty skyrocketed 916.70 points or 3.82 per cent to close at 24,924.70. In intra-day trade, the index zoomed 936.8 points, or 3.90 per cent, to 24944.80. The rally was supported by an across-the-board buying led by IT, metal, realty and technology shares. Sensex had previously posted its biggest single-day gain of 2507.45 points and Nifty by 733.20 points on June 3, 2024.

Following the sharp rally, the market capitalisation of BSE-listed firms jumped by ₹16,15,275.19 crore to ₹4,32,56,125.65 crore ($5.05 trillion) in a single day.

“Buoyed by the India-Pakistan secession of firing, the key benchmark indices of the Indian stock market had a big gap-up opening on Monday. Apart from thawing geopolitical uncertainties, the US-China trade deal, the US-UK trade deal, the India-UK FTA (Free Trade Agreement) are fuelling investors’ sentiment,” said Devarsh Vakil, head – Prime Research, HDFC Securities.

“Trading volumes on the NSE cash market were higher by 13 per cent than yesterday. Volatility index, India VIX witnessed a sharp drop of 15 per cent in today’s session,” said Vakil.

“Confluence of positive geopolitical and economic developments — the secession of firing between India and Pakistan, coupled with a breakthrough trade agreement between the US and China — sparked the strongest daily market rally in recent times,” Vinod Nair, head of research, Geojit Investments Limited, said.

Sustained FII inflows, along with a resurgence in retail participation fuelled by expectations of a swift improvement in business sentiment, propelled today’s upside, he added.

The BSE smallcap gauge surged 4.18 per cent, and the midcap index jumped 3.85 per cent.

As many as 3,545 stocks advanced while 576 declined and 133 remained unchanged on the BSE.

Global indices

Among other Asian markets, South Korea’s Kospi, Japan’s Nikkei 225 index, Shanghai’s SSE Composite index and Hong Kong’s Hang Seng settled higher.

Stocks were also surging on Wall Street after China and the United States announced a 90-day truce in their trade war. The S&P 500 was 2.7 per cent higher in early trading on Monday. The Dow Jones Industrial Average jumped 2.4 per cent, and the Nasdaq composite was 3.7 per cent higher.

Stock markets in Pakistan also rallied, with the benchmark KSE-100 index jumping more than 9 per cent on Monday.

Gold tanks

Gold prices tanked sharply by ₹3,400 to ₹96,550 per 10 grams in the national capital on Monday as traders shifted from safe-haven buying. In Calcutta, gold prices were down by ₹3300 to ₹93,650 per 10 grams.

“Investors turned risk-on with safe-haven gold taking a beating while equities turned out to be clear winners on the back of broad-based buying support. With talks on global tariff seen on a smooth path, equities could gain traction going ahead,” Prashanth Tapse, senior VP (Research), Mehta Equities Ltd, said.