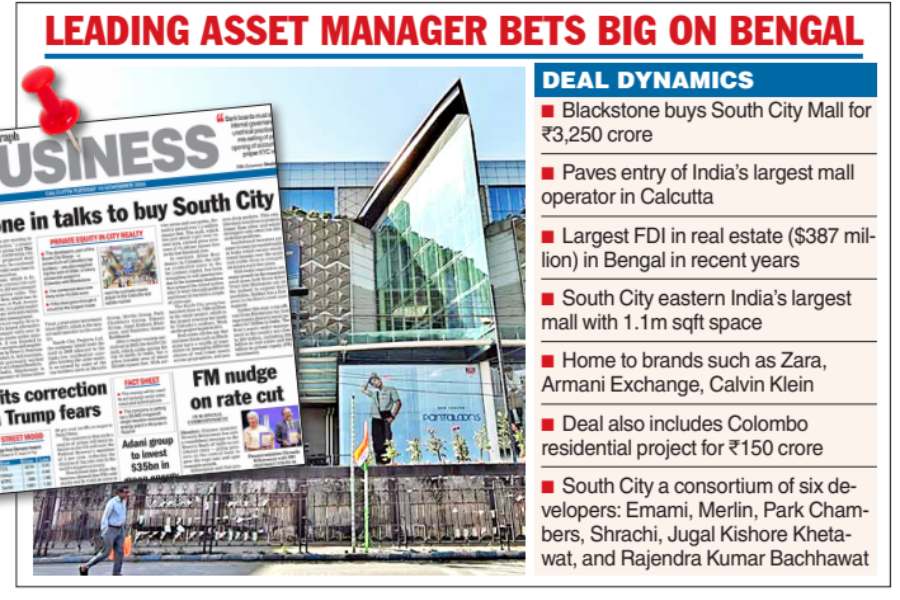

The New York-based Blackstone group, which manages assets of over $1.2 trillion, has acquired Calcutta’s South City Mall, one of India’s premier retail spaces, for ₹3,250 crore, ushering the entry of the world’s largest alternative asset manager to the city’s real estate space.

The transaction is billed as one of the largest in the organised retail sector by value in the country so far and marks a departure for Calcutta, which has seen the exit of a national player like DLF in recent months.

The deal will also qualify as the largest foreign direct investment (FDI) in Bengal in recent years and certainly the biggest in the real estate sector, underlining the demand for top grade retail space in Calcutta, eastern India’s largest commercial hub.

The Telegraph had first reported that owners of the mall were in talks with Blackstone on November 19, 2024.

Built in 2007 by a consortium of six prominent business families and developers, South City on Prince Anwar Shah Road is spread over 7 acres of land with a built-up space of about 1.1 million square feet. Developers refurbished it with a capital cost of ₹150 crore in 2017, giving the mall a new lease of life.

The mall, which houses a mix of premium and mass market fashion retailers such as Armani Exchange, Calvin Klein, Zara and F&B operators such as Specialty Restaurant’s Mainland China and Riyasat and eastern India’s largest food court, generates business worth ₹1,800 crore a year.

The mall itself has a turnover of ₹170 crore, which comes from rent, revenue share, parking fees and promotional activities.

Commenting on the deal, Asheesh Mohta, head of real estate acquisitions — India, Blackstone, said the firm is “thrilled to strengthen our presence in India and invest in this iconic asset”.

“We are committed to continuing South City Group’s wonderful work and positioning South City Mall for long-term success, benefiting from our scale, operational expertise, and deep experiences in the retail sector, particularly in India where we own one of the largest retail portfolios,” Mohta noted. His sentiment was echoed by Prakash Bachawat, a key stakeholder in the company. Blackstone is the main sponsor of India’s largest mall operator Nexus REIT (real estate investment trust).

Sushil Mohta, director of South City Projects Ltd and chairman of Merlin Group, described the transaction as a vote of confidence in eastern India’s retail ecosystem.

“We had many offers but zeroed in on Blackstone, which already owns 18 malls in the country and a leading office space and hotel owner,” he said.

Soumendu Chatterjee, regional director — land, of Anarock Group, which was the sole adviser to the transaction, observed that South City mall has a very high footfall, with daily visitors ranging between 55,000 and 60,000, surging to 75,000–200,000 during weekends and festive seasons.

Apart from the mall, the South City Group also sold unsold inventories in its luxury residential project Altair in Colombo to Blackstone for an estimated value of ₹150 crore, taking the total transaction to ₹3,400 crore. Sources said Blackstone acquired South City Projects Ltd, which has the mall and Colombo venture, as a going concern.

Mall dynamics

Calcutta’s retail malls have been buzzing post pandemic as the last mall which came into existence was 10 years back.

Consultancy firm CBRE said retail leasing in Calcutta was negligible due to zero grade A supply. Rental value in malls in South Calcutta has been in the range of ₹360-400 per square foot a month.

However, a new mall, being built by Mumbai’s Phoenix Group, is coming up near Alipore and will be ready by 2027. Moreover, Mohta’s Merlin Group is redeveloping a mall in Joka as Acropolis South.