Government-owned Andrew Yule will offload a 2 per cent stake in lubricants and grease maker Veedol Corporation through an offer for sale. The company plans to sell 3.48 lakh shares and has approved a floor price of ₹1,566 per share, lower than Thursday’s closing price of ₹1,685.10 per share at the Bombay Stock Exchange.

“The board of directors of the company, at its meeting held on June 9, 2025, has approved the sale of 3,48,480 equity shares of Veedol Corporation Ltd., representing 2 per cent of the issued and paid-up equity share capital of Veedol, held by the company, by way of an offer for sale through the stock exchange mechanism, in accordance with the applicable law,” said city-based Andrew Yule in a stock exchange filing on Monday.

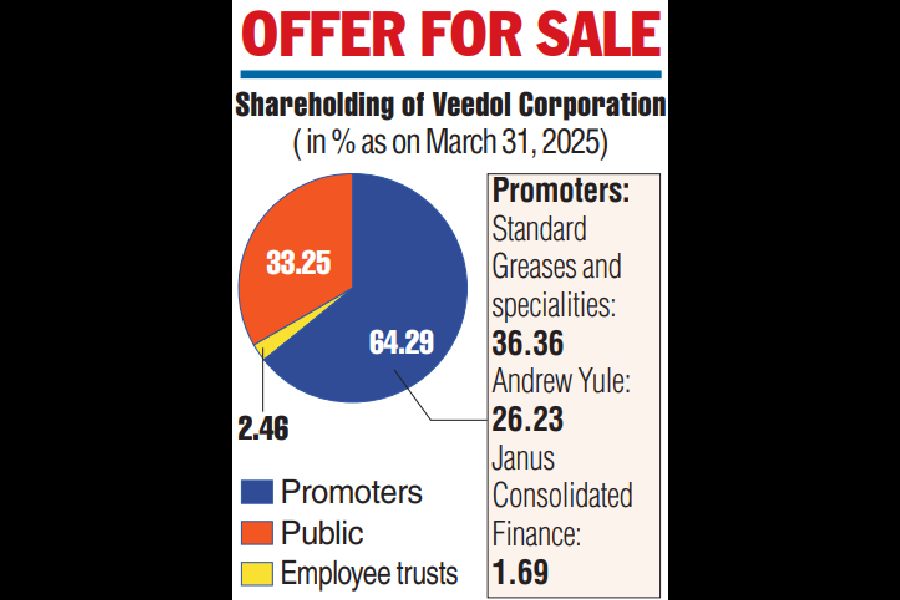

Veedol currently has three promoters — Mumbai-based Standard Greases and Specialities (36.36 per cent), Andrew Yule (26.23 per cent) and Janus Consolidated Finance (1.69 per cent) — collectively holding a 64.29 per cent stake. LIC is among the public shareholders of Veedol with a stake of 1.12 per cent.

In the stock exchange filing, Andrew Yule said that the offer for sale will take place over two trading days on June 10 and 11, and only non-retail investors will be allowed to place their bids on June 10.

A minimum of 25 per cent of the offer shares shall be reserved for mutual funds and insurance companies, subject to receipt of valid bids at or above the floor price, while 10 per cent of the offer shares shall be reserved for allocation to retail investors, subject to receipt of valid bids.

Calcutta-based Veedol has reported a consolidated net profit of ₹168.75 crore in FY25, up by 18.06 per cent from ₹142.93 crore in FY24. Total income in FY25 was ₹1,988.87 crore, up 1.95 per cent from ₹1,950.81 crore in FY24.

Diversified public sector company Andrew Yule, which has businesses ranging from engineering, electrical and tea gardens in Bengal and Assam, has seen its losses contract to ₹2.83 crore in FY25 compared with ₹47.47 crore in FY24. Total income during FY25 was ₹375.27 crore, up 7.67 per cent from ₹348.52 crore in FY24.

Notably, back in 2015, Veedol, which was then known as Tide Water Oil Co. (India), had seen a takeover tussle, when it had received a surprise open offer from a private entity Standard Greases and Specialties, which then held a 23.24 per cent stake in the company.

Andrew Yule, which was then the promoter of Tide Water Oil, had a 26.22 per cent stake.

However, later in 2026, Standard Greases became a co-promoter of the company.