Vedanta Resources Ltd, the London-based parent of India’s prominent mining major Vedanta, has come under attack from US-based short seller Viceroy Research, which alleged that the holding company is ‘systemically draining’ the subsidiary.

This is the second instance of an Indian conglomerate feeling the heat of an offshore short seller after Hindenburg Research took a potshot at the Adani group in 2023, kicking off a political firestorm.

In an 87-page report published on Wednesday, Viceroy said the entire group structure of Vedanta, promoted by billionaire Anil Agarwal, “is financially unsustainable, operationally compromised, and poses a severe, under-appreciated risk to creditors”. Viceroy has taken a short position in VRL’s bonds.

A spokesperson for the Vedanta group said the report was “a malicious combination of selective misinformation and baseless allegations” and that its authors issued it without contacting the group.

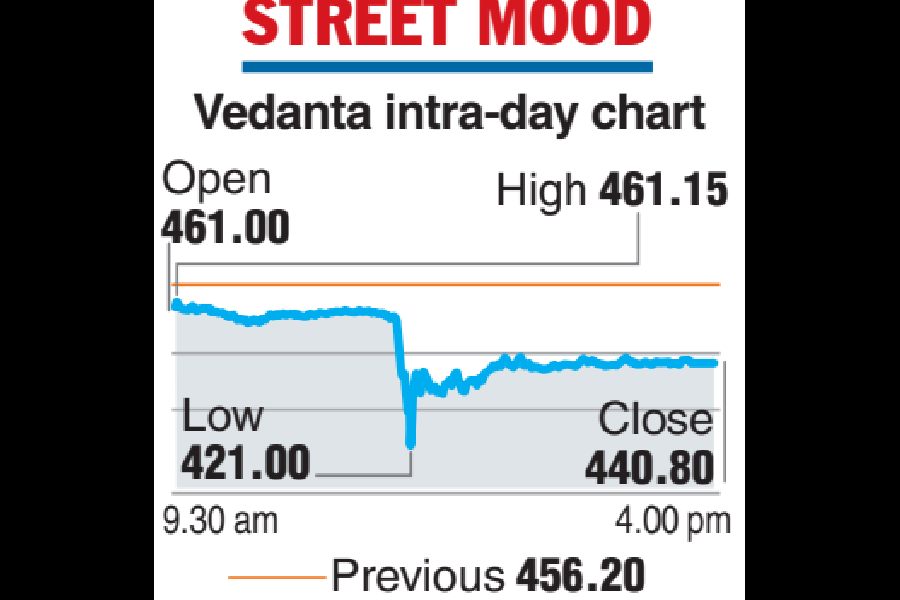

Vedanta, which is a major producer of zinc, aluminium, copper, and oil and gas, plans to split into multiple separate entities and said in 2024 that it aims to cut its debt pile by $3 billion in three years. The company’s stock initially plunged 8 per cent intra-day before trimming the losses to end the day with a cut of 3.38 per cent only.

Viceroy Research LLC, which identifies itself as an investigative financial research group registered in Delaware USA, was formed by Fraser John Perring with Australian partners Aiden Lau and Gabriel Bernarde in 2016.

The short seller, whose work on Germany’s payment giant Wirecard, established the firm’s credential in the financial market, said to service its own debt burden of $4.9 billion, the parent is forcing the operating company (Indian subsidiary) to take on ever-increasing leverage and deplete its cash reserves.

This looting erodes the fundamental value of Vedanta, which constitutes the primary collateral for VRL’s own creditors, it added. “Consequently, VRL’s actions to meet its short-term obligations directly impair its creditors’ long-term ability to recover their principal, a situation that resembles a Ponzi scheme,” it said, adding that this arrangement has pushed the entire group to the brink of insolvency.

Vedanta approved dividends worth ₹75,800 crore ($8.8 billion) in the last four fiscal years, while its unit Hindustan Zinc declared ₹57,300 crore as dividends over the same period, exchange filings show. Vedanta Resources holds 56.38 per cent in Vedanta and 61.62 per cent in Hindustan Zinc.

Vedanta said the Viceroy report “only contains compilation of various information which is already in the public domain” and alleged that the “timing of the report is suspect”.