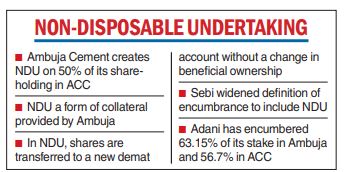

Ambuja Cements said on Wednesday it has created non-disposable undertaking (NDU) on over 50 per cent of its shareholding in subsidiary ACC Ltd as “collateral for loans taken by the company”.

The Adani group has acquired Ambuja Cements and ACC — through a Mauritius-based SPV Endeavour Trade and Investment Ltd (ETIL), which is owned by Xcent Trade and Investment Ltd (XTIL). NDU is a type of encumbrance, different from lien or the pledge of shares. In the pledge of shares, lenders invoke the pledge and sell the shares if the promoters fail to come up with additional collateral. In NDU, the shares are transferred to a new demat account without a change in the beneficial ownership, but with the condition that the transferee will not sell the shares.

While promoters have entered into such arrangements in the past, market regulator the Securities and Exchange Board of India (Sebi) had said in a circular in 2017 that depositories must capture and record NDUs in a bid to improve transparency. There was no framework to capture the details of NDU in the depository system then and it happened outside the system. Subsequently, in 2019, Sebi widened the definition of encumbrance to include NDU.

Last week, Adani said it had encumbered its entire stake worth $13 billion in Ambuja Cements and ACC, days after completing its $6.5-billion acquisition of the two companies. The NDU is part of that encumbrance. The Adani group has encumbered its 63.15 per cent stake in Ambuja Cements and 56.7 per cent stake in ACC (of which 50 per cent is held by Ambuja) to the Hong Kong Branch of Deutsche Bank AG. On Wednesday, the shares of Ambuja Cements closed flat at Rs 500.20 while the ACC share ended 1.13 per cent lower at Rs 2,348.70 in the BSE. On September 16, the group had completed the acquisition of Holcim’s cement operations in India for $6.5 billion.

Credit enhancement

The market regulator, Sebi, has come out with a new framework for credit rating agencies (CRAs), involving the ratings of securities having explicit credit enhancement features. Credit enhancement, which improves the rating of an issuer, entails the assurance of repayment by another entity if there is difficulty on payment of interest or principal. The new framework, applicable from January 1, 2023, is aimed at enhancing transparency and improving the rating process, Sebi said in a circular. Under the rule, rating agencies can assign the suffix “CE” to the rating of instruments having explicit credit enhancement. Sebi said the press release for credit ratings, with or without the CE-suffix, need to contain certain disclosures.

This will enable investors to understand the extent of credit enhancement provided by a third party or parent or group company, The disclosures relate to unsupported ratings without factoring in the explicit credit enhancement or specified support considerations and supported rating after factoring in the explicit credit enhancement.

Meanwhile, the share of industrial loans in total credit has been gradually declining over the last decade while that of personal loans is on the rise, the Reserve Bank said on Wednesday. Both industrial and personal loans had nearly 27 per cent credit share each in March 2022, the RBI said. Earlier this month, finance minister Nirmala Sitharaman nudged the corporate sector to increase investment in the manufacturing sector. The Reserve Bank report further said the portion of small-sized loans is also going up steadily.