The Telegraph

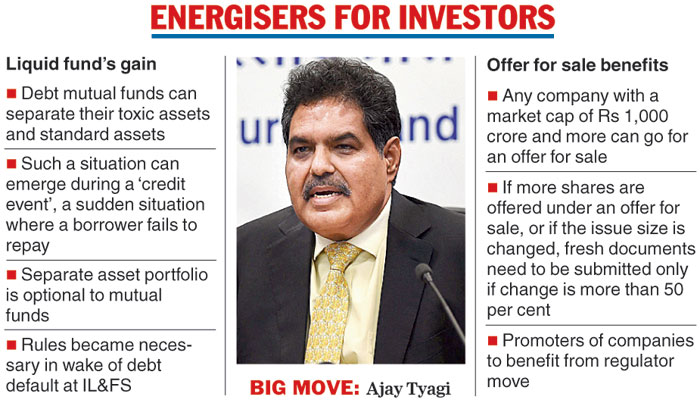

Sebi on Wednesday offered some cheer to the promoters of companies looking to divest their stakes through the offer-for-sale (OFS) route when it expanded the universe of firms to whom this mechanism will be available.

The OFS, which is akin to a follow-on offer, permits the promoters of listed companies to dilute or offload their holdings in a transparent manner through the stock exchanges.

According to the extant norms, the OFS route is open to promoters or promoter group entities of top 200 companies by market capitalisation in any of the last four completed quarters.

At its board meeting held on Wednesday, the Securities and Exchange Board of India decided to expand the list of eligible companies. It said the OFS mechanism shall be available to shareholders of companies with market capitalisation of Rs 1,000 crore and more.

The capital market watchdog further said if a seller fails to get sufficient demand from non-retail investors at or above the floor price on the day of the offer, the seller has the option to cancel the offer.

The Sebi board has also cleared a proposal to change the norms requiring the filing of a fresh offer document for OFS where there is a change in the number of shares offered for sale, or in the estimated issue size, by more than 50 per cent.

At present, in case of any increase or decrease in the estimated issue size by over 20 per cent, the fresh filing of the offer document with Sebi is required. Such requirement is for both fresh issues and OFS.

In another reform, Sebi allowed custodial services in goods underlying commodity derivative contracts to enable the participation of institutional investors in the commodity derivatives market. Towards this end, the Sebi board approved proposed amendments to the Sebi (Custodian of Securities) Regulations, 1996.

This move will mean that existing custodians will be permitted to add commodities as an asset class and provide the physical delivery of both securities and commodities.