Chartered Financial Analyst: Career Scope and Job Opportunities in India

Chartered Financial Analyst (CFA) is one of the most prestigious post-graduate programs in finance that many commerce graduates undertake for a high-performing career. After a bachelor’s degree, students can enrol for the course at the CFA Institute and earn a globally-accredited certificate within 1.5-4 years. The program equips the learners with comprehensive knowledge of investment banking and grooms them to become skilled financial experts.

India witnessed a 30% annual rise in CFAs and became the third-largest market for CFA after China and the USA. There are 3,500 CFA charter holders in the country, and an increasing number of students register for the course each year. Aligning with the booming learner base and rising job opportunities, the CFA Institute offers scholarships to eligible students, making the course more accessible and affordable.

Though the program primarily caters to students with a commerce background, it attracts science and humanities graduates with a definite inclination toward the capital market. That’s because the certificate opens the avenue to high-paying job offers and opportunities across various sectors. Let’s dive deep into what career options you can get after qualifying for CFA and how much can be your expected remuneration.

The CFA program covers every industry in-depth regarding core business operations and fundamentals. Thus, CFA professionals have a high demand in sectors like:

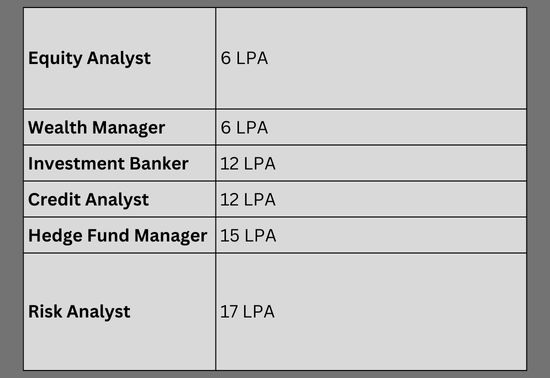

Since the course empowers its candidates with in-depth financial knowledge, they can find job opportunities in banking and finance institutions, legal firms, tech firms, investment firms, stock broking companies, trademark companies, and auditing firms. Though a CFA can earn anywhere between ₹9.8 lakhs for a level 1 fresher to ₹44 lakhs for a charter holder, the average annual salary varies across professions as follows:

CFA allows professionals to work independently as consultants without working for a company. However, gaining hands-on experience and initial networking may help them serve their independent client base. If you want to join a company after your CFA, you can find opportunities in the following areas:

1. Investment Banking

Every company needs to raise capital from the market to run its business. An investment banker performs valuation, recommends product offerings, executes private equity transactions, mergers, and acquisitions, performs due diligence, and develops client relationships to help the company raise funds. You should have impeccable financial skills, networking and communication skills, and persuasiveness to thrive in this profession.

2. Portfolio Management

A portfolio manager manages a fund’s assets, implements investment strategies, and monitors daily portfolio management activities. Whether you deal with closed funds, open mutual funds, venture capital funds, or exchange-traded funds, you should have extraordinary research skills and innovative thinking to originate strategic investment ideas.

3. Risk Management

A risk manager controls risk-related elements, manages liability programs, collects risk data, respond to internal and external inquiries, and conducts analysis to resolve queries regarding risk processes. You should possess magnificent numerical skills, a diplomatic attitude, a sharp analytical mind, and excellent communication skills to negotiate and mitigate risks as required.

4. Private Banking

Unlike conventional retail banking, private banking involves investment, tax management, and personalised financial services to high net-worth individuals and private clients. As a private banker, you are responsible for analysing financial information, implementing recommendations, managing personal client portfolios, and building trust with current and potential clients to facilitate higher investment returns.

5. Market Research Analysis

A market research analyst analyses data about market demands for different products, designs questionnaires, interprets data with statistical methods, and makes recommendations based on the findings. You will manage a team of data collectors and assistants, conduct surveys and interviews, and manage budgets for your clients’ market presence.

CFA is a dignified finance program that bridges the gap between academics and industry. It instills deep knowledge across a spectrum of investment and asset management positions and offers a lucrative career for candidates. With the rise of NFT and cryptocurrency, the demand for skilled CFA professionals will likely spike in India and abroad. Thus, it’s high time to prepare for the examinations under the guidance of CFA-qualified industry experts and India’s leading educational institute. Enrol for a suitable training course and make yourself exam-ready with the best educational practices.

About the author

Founded in 2015, Anant Bengani is the Co-Founder & Director of Zell Education which bridges the gap between academic excellence and practical skill development. As a cutting-edge learning platform, Zell offers comprehensive training to aspiring finance and accounting students. It is a leading institute focused on preparing students with the necessary knowledge and skills to excel in finance and accounting in today's competitive world.