Thursday, 25 April 2024

Thursday, 25 April 2024

Thursday, 25 April 2024

Thursday, 25 April 2024

As Usha Uthup receives Padma Bhushan, KKR celebrates in Knight’s style

Mimi embodies the spirit of Earth Day by picking plastic on the beach

Marvel releases trailer for ‘Deadpool & Wolverine’

Salman Rushdie’s ‘Knife: Meditations After an Attempted Murder’ is out now

This Sugar-Free Fig and Walnut Kulfi is the ultimate summer treat

Privilege may make one indifferent to assertions of identity and communal relationship, but marginality and fear of oppression are far likelier to make one withhold or even hide such assertions

SAIKAT MAJUMDAR

Now the geostrategic risks Muizzu took appear to have paid off. China knows that in Muizzu it has a partner who is in complete command in the Maldives, and who it can invest in

CHARU SUDAN KASTURI

Some argue that the cops wearing Hindu attire is nothing more than a gimmick initiated by senior police officers who want to please their current political masters during the election season

SUSHANT SINGH

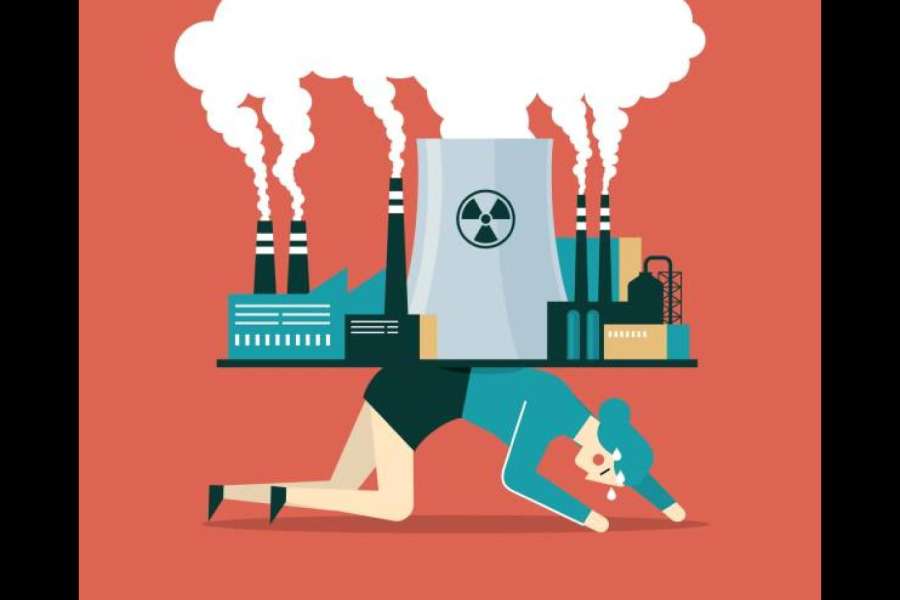

The demand for energy and other resources will be far greater than what it is now, not only because of the higher numbers but also because of greater consumption by those moving out of poverty

ANAMITRA ANURAG DANDA

There is reason to believe that BJP is now falling back on its tried-and-tested polarising policy that always yields dividends. This merits speculation about the likely causes of this shift

THE EDITORIAL BOARD

Lootere stars Vivek Gomber, Rajat Kapoor, Amruta Khanvilkar, and Chandan Roy Sanyal in key roles