Tuesday, 23 April 2024

Tuesday, 23 April 2024

Tuesday, 23 April 2024

Tuesday, 23 April 2024

We have the first look of the dystopian-mythology epic, ‘Kalki 2898 AD’

Be informed about bees on Earth Day, 2024

Flaunt your summer drapes from The India Craft House

Tribe cafe, Golpark, is hosting a photography exhibition by Mala Mukherjee

Parineeti Chopra sings a Punjabi track from ‘Amar Singh Chamkila’

Some argue that the cops wearing Hindu attire is nothing more than a gimmick initiated by senior police officers who want to please their current political masters during the election season

SUSHANT SINGH

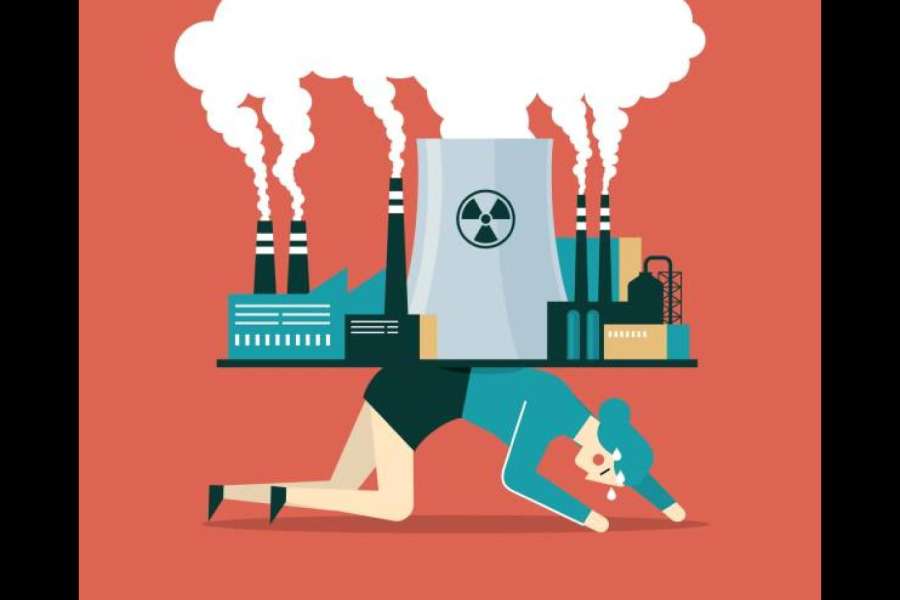

The demand for energy and other resources will be far greater than what it is now, not only because of the higher numbers but also because of greater consumption by those moving out of poverty

ANAMITRA ANURAG DANDA

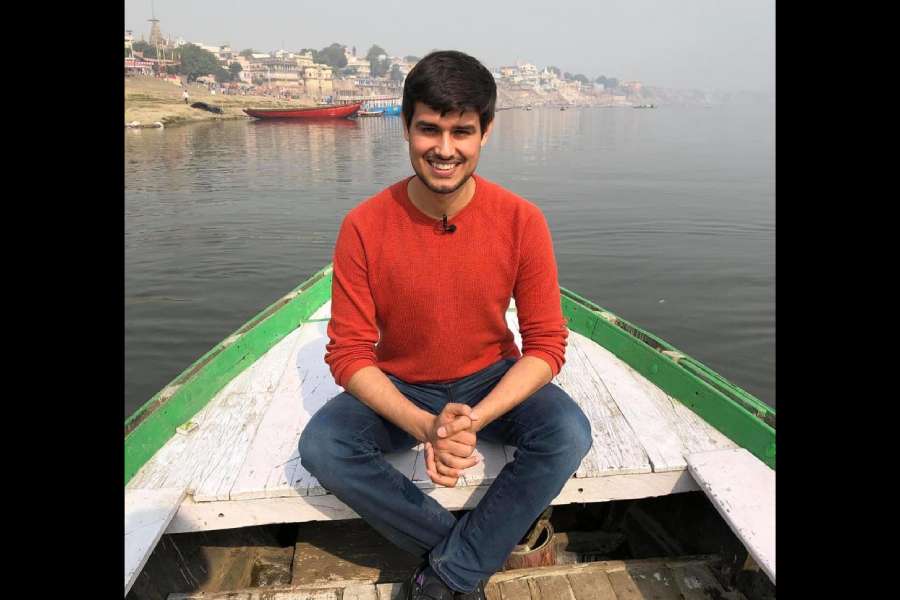

Whether it is in the video on the Adani Group or in the video about unemployment, Rathee likes to examine the biggest companies from the lens of jobs they are creating

SEVANTI NINAN

Improvement in standards of living among the affluent can prevent communicable diseases. But vaccines play a key role among disadvantaged constituencies to help them tide over medical crises

AMITAV BANERJEE

It appears that the Bharatiya Janata Party's numerical majority, achieved through means fair and foul, could also render some of the basic constitutional tenets vulnerable in the public eye

THE EDITORIAL BOARD

The film stars Paritosh Tiwari, Swaroopa Ghosh, Bonita Rajpurohit, Swastika Mukherjee and Abhinav Sinha