Monday, 06 May 2024

Monday, 06 May 2024

Monday, 06 May 2024

Monday, 06 May 2024

Ranveer Brar pays tribute to Ray on the filmmaker’s birth anniversary

Benedict Cumberbatch gives a cerebral performance in ‘Eric’ trailer

Ritabhari Chakraborty shares photos from her London trip on Instagram

This Alphonso mango gateaux recipe by Rahul Arora will make you drool

Keep harmful UV rays at bay with Suroskie's sunscreen

The attitude of the West to its Muslim citizens is beginning to mirror their hostility towards non-client Muslim states abroad. Some of this is a hangover of the ‘war on terror’ since 9/11

MUKUL KESAVAN

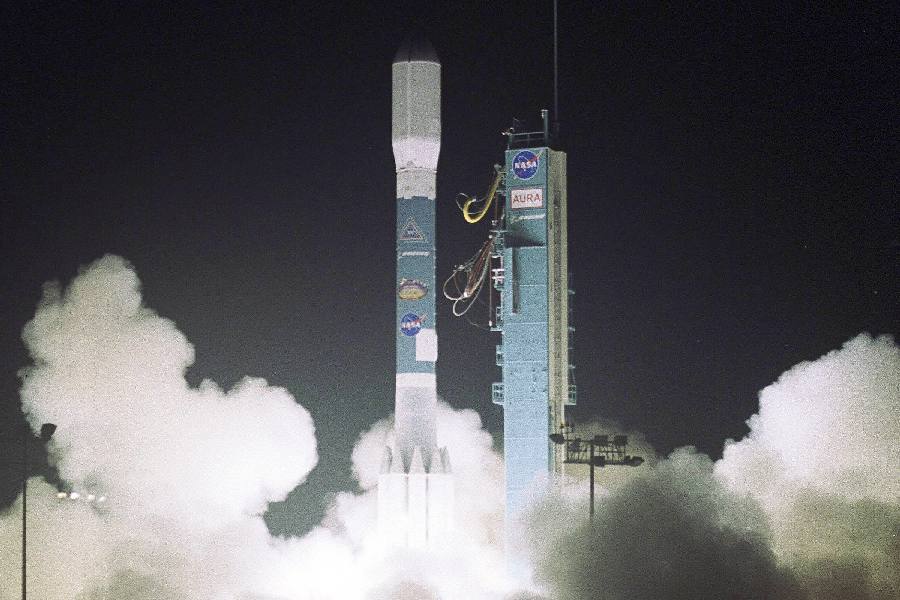

The ideological penetration of Indian science by Hindutva was starkly illustrated by a series of nine linked tweets issued by the secretary of the department of science and technology last month

RAMACHANDRA GUHA

For the last three hundred years, the world is being ruled by the West. Naturally, in all wars during this period, the narratives floated by the West have dominated those framed by its enemies

KAUSHIK BHATTACHARYA

For JNU to regain its position, the unique features that made it a great institution need to be brought back in the form of inclusive admission, academic practices, and participatory governance

SUKHADEO THORAT

According to a global gender health gap analysis published in The Lancet Public Health, men experience a greater degree of deteriorating health and have a higher burden of diseases

THE EDITORIAL BOARD

The film co-starring Hema Malini, Sharmila Tagore and Parveen Babi was released on April 23, 1982