Tuesday, 14 May 2024

Tuesday, 14 May 2024

Tuesday, 14 May 2024

Tuesday, 14 May 2024

![Narendra Modi and Mallikarjun Kharge [Inset]](https://assets.telegraphindia.com/telegraph/2024/Mar/1711893412_1704002323_1700975369_1694764982_modi-kharge.jpg)

Nussrat’s li’l munchkin Yishaan makes social media debut on Mother’s Day

Taimur and Jehangir help Kareena polish off her Mother’s Day cake

It’s ‘family funday’ for Priyanka, Nick and li’l Malti Marie

Akshata Murty plays ball with school kids at 10 Downing Street

Stand-up comedian Shane Gillis is the face of new Netflix comedy, ‘Tires’

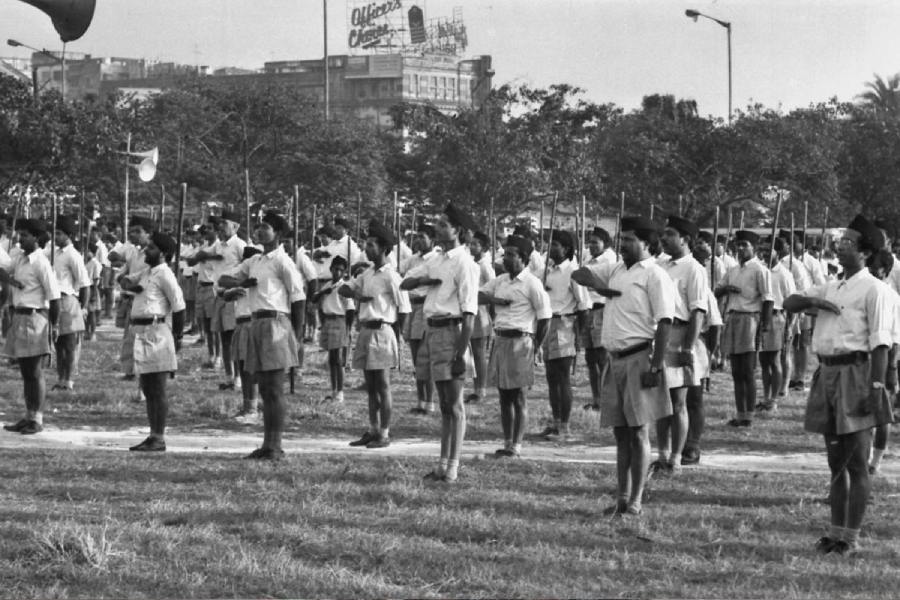

Learning from the past involves seeing the interaction between deep structures and processes, on the one hand, and among contingency, conjuncture, collective will and individual leadership on the other

TIMOTHY GARTON ASH

An FTA with the United Kingdom is in the works; once implemented, the UK-India FTA will be the first such free trade agreement that India would have with a major Western power

PRANAY SHOME

The bigotry that the Congress used as a touch paper in 1984 had to be, therefore, a form of Hindu communalism, born in part out of a resentment of Sikh secessionism and militancy

MUKUL KESAVAN

Things are often aggravated in the hills. The seven-phase Lok Sabha election heightens the drama with ominous warnings that Sikkim might one day acquire a Bihari or Marwari chief minister

SUNANDA K. DATTA-RAY

The bench even admonished counsel for bringing up the name of the former judge of Calcutta HC, Abhijit Gangopadhyay, who is now the Bharatiya Janata Party's LS candidate from Tamluk

THE EDITORIAL BOARD

21-year-old Arhaan Khan studied filmmaking in the US; his podcast Dumb Biryani is streaming on YouTube