Tuesday, 07 May 2024

Tuesday, 07 May 2024

Tuesday, 07 May 2024

Tuesday, 07 May 2024

Alia looks like a dream in a Sabyasachi for Met Gala 2024

Yuvraj Singh poses with NBA, F1 and T20 World Cup trophies at Miami GP

Dulquer Salmaan’s birthday post for dear daughter is #daddygoals

Ridhima and Gaurav enjoy with baby Dheer in Koh Samui

Check out the Summer Solace menu at The Astor

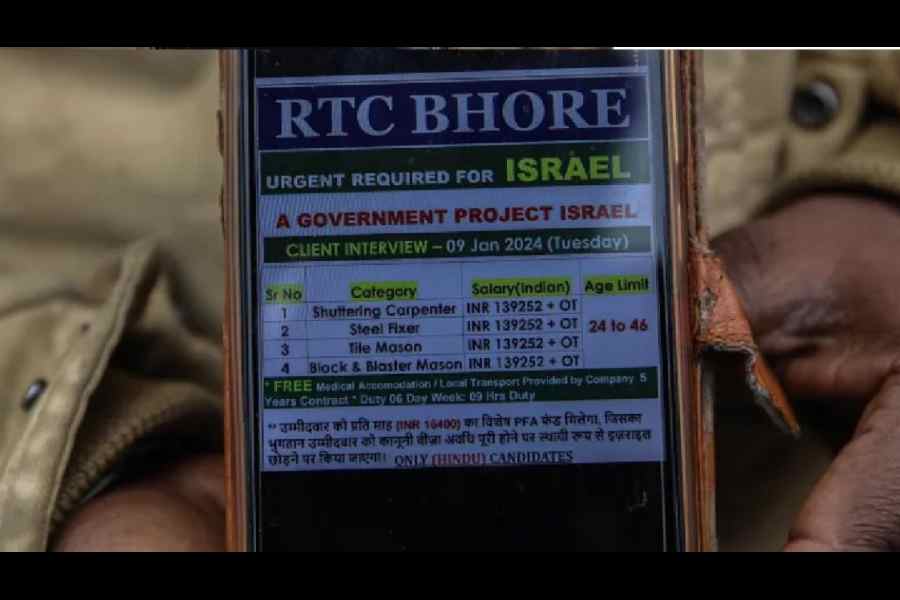

Israel is not the only country where Indian workers face dire working situations. Exploitation of Indian workers under conditions akin to slavery in Singapore & Gulf states has been a long-standing issue

CAROL SCHAEFFER

The inclusionary spirit of nation-building was distilled in the Constitution that directs the State to protect equality and non-discrimination that nurture the nation’s diversity

SUHIT K. SEN

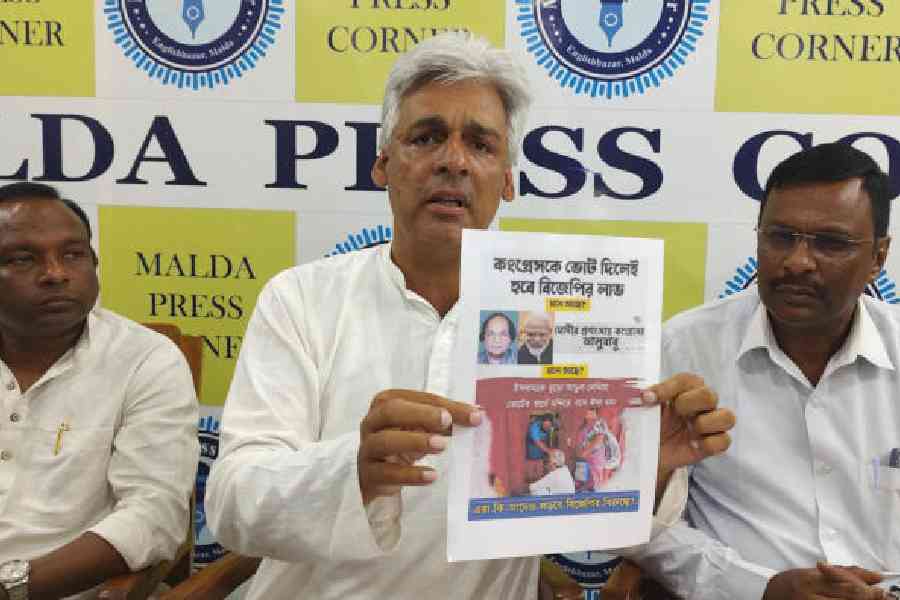

Let us reflect on some hard realities of India. ‘Mere’ corruption is no longer an electoral issue: we do not shun politicians because they might have their hands in the till or in our pockets

SUKANTA CHAUDHURI

Epidemic Plan, envisioned as a collaborative endeavour among the Central govt, state governments, and relevant stakeholders, aims to provide a comprehensive blueprint for coordinated action

BASIL GUPTA

Intelligence-sharing has been at the heart of India’s deepened strategic ties with US & its allies. Such exchange of information relies on mutual trust between intelligence agencies

THE EDITORIAL BOARD

The Deol brothers were the guests on Episode 6 of the Netflix comedy series led by Kapil Sharma and Sunil Grover