Wednesday, 17 April 2024

Wednesday, 17 April 2024

Wednesday, 17 April 2024

Wednesday, 17 April 2024

KJo shares the poster of his next — ‘Mr. & Mrs. Mahi’

Can Shantanu Maheshwari stay away from dance for a whole vacation?

Hardik Pandya looks dapper in white

Enrol for a delightful Summer Dessert Masterclass at Yauatcha, Quest mall

Get playful this summer with Etude’s new makeup range

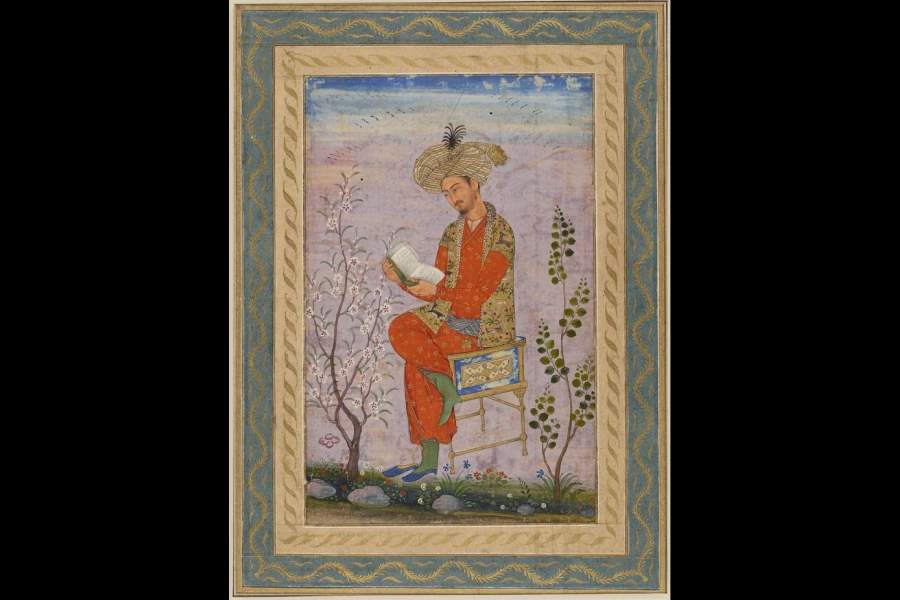

When the trajectories of languages get snapped, the accumulated wisdom in those languages, too, gets submerged and continues to survive in severely truncated, irreparable and insensible forms

G.N. DEVY

The manipulation of brain activity has also been around for some time now and has been ramped up with Artificial Intelligence-based ‘interventions’

PRAMOD K. NAYAR

Shortly after the missile strike, President Ebrahim Raisi of Iran issued a statement declaring that the Revolutionary Guard had “taught a lesson to the Zionist enemy”

THOMAS L. FRIEDMAN

China continues to warn regional players of negative consequences of their actions. Yet, it is Beijing’s own behaviour that is reshaping the Indo-Pacific landscape

HARSH V. PANT

Equality and uniformity are not identical, neither is equality an excuse to stifle all beneficent personal laws of minority communities, even when they protect women

THE EDITORIAL BOARD

Imtiaz Ali, Diljit Dosanjh and Parineeti Chopra were the guests in the third episode of the comedy series headlined by Kapil Sharma