Saturday, 27 April 2024

Saturday, 27 April 2024

Saturday, 27 April 2024

Saturday, 27 April 2024

The scapegoating of Sri Lankan Tamils has broadly followed similar patterns as in India, even if the axis of persecution took place more on ethnic/linguistic rather than religious lines

ASIM ALI

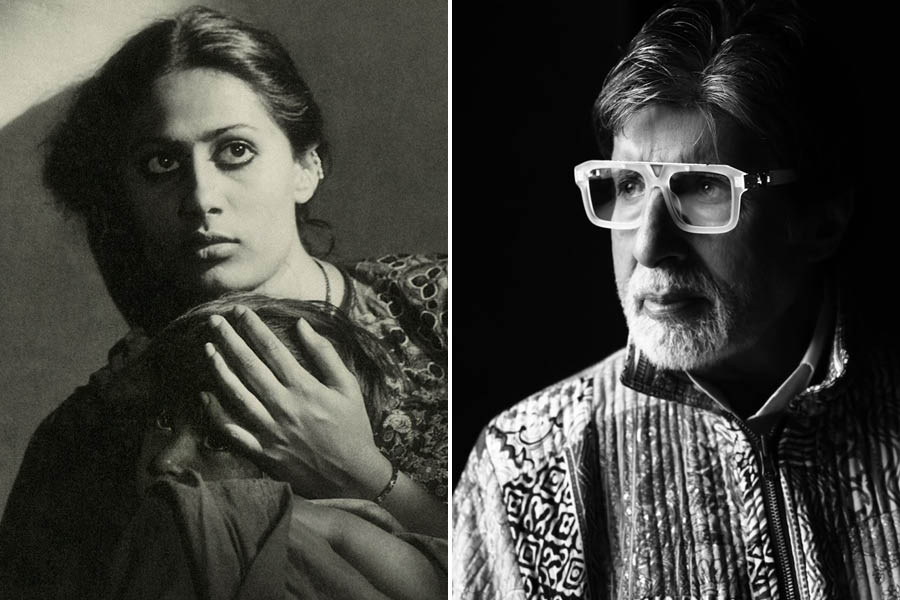

The truths we express through our art are selected after careful consideration. Only those that skim the surface or keep our deep-seated beliefs intact find artistic expression

T.M. KRISHNA

Bengali does not have one ‘single’ word for them, although they are variously described as unmarried, widowed, separated or divorced. Nor does Hindi. Not that they need new descriptions

CHANDRIMA S. BHATTACHARYA

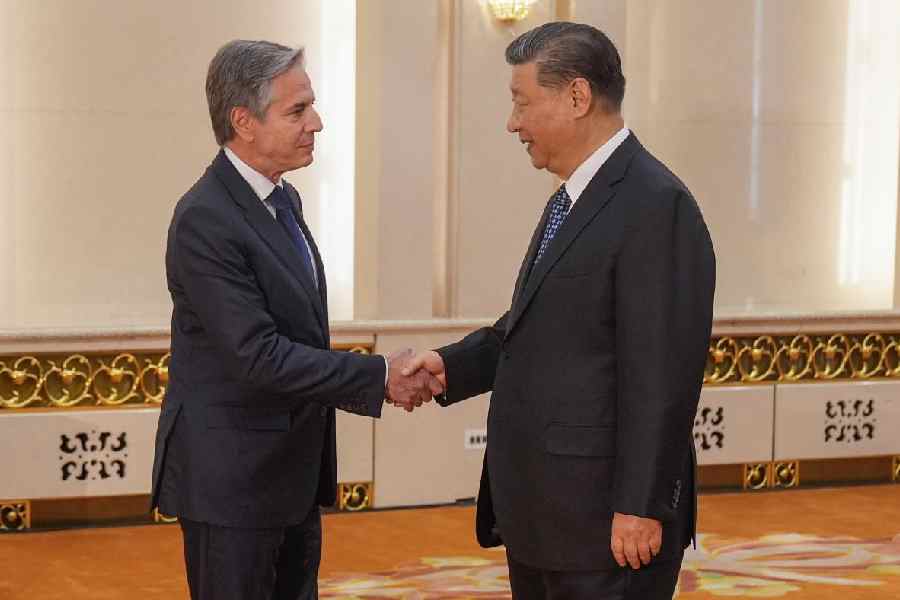

For the man who plays minder to Rahul Gandhi on his overseas visits, the Western media coverage seemed to imply that Modi had lost the plot and was on the cusp of being perceived as a global pariah

SWAPAN DASGUPTA

The govt, given the pressures on it from constituencies averse to climate change mitigation, cannot be expected to invest in sensitising the people. It must be done before time runs out

THE EDITORIAL BOARD

The film stars Paul Rudd, Carie Coon, McKenna Grace, Finn Wolfhard, Kumail Nanjiani, Dan Akroyd, Ernie Hudson and Bill Murray