Saturday, 04 May 2024

Saturday, 04 May 2024

Saturday, 04 May 2024

Saturday, 04 May 2024

A vacation can’t get in the way of Milind Soman’s fitness regime

This unique filter makes you look like Sheldon Cooper!

Enjoy the ‘zaika’ of north India with celebrity chef Sweety Singh

Make Lemon Chilli cocktail — the perfect way to keep cool this summer

Catch bassist Mohini Dey playing for Willow Smith’s Tiny Desk Concert

For JNU to regain its position, the unique features that made it a great institution need to be brought back in the form of inclusive admission, academic practices, and participatory governance

SUKHADEO THORAT

CHINA DIARY | A furious counsellor probably decided to teach the fresher a lesson she’d never forget, or at least that’s how Chun’s mother sees it. The college, expectedly, refutes this

NEHA SAHAY

The issue of electoral bonds in India — they have been declared illegal by the Supreme Court — has some parallels with the Super Political Action Committees in the United States

LUV PURI

This is why reading translations of works written in languages other than those one is conversant in is important: it exposes you to ideas you might not have encountered otherwise

RISHI MAJUMDER

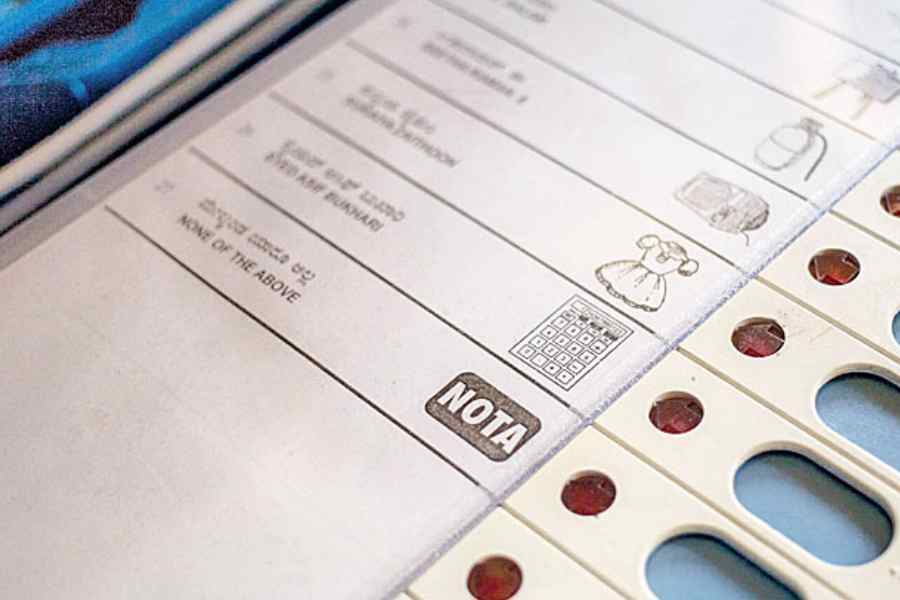

Option for Nota was granted in 2013, but its effect has remained symbolic since then. Nota votes register people’s dissatisfaction with all candidates, yet nothing is done about it

THE EDITORIAL BOARD

The Fall Guy is directed by David Leitch, a former stuntman who has helmed films like Atomic Blonde and Bullet Train