Friday, 19 April 2024

Friday, 19 April 2024

Friday, 19 April 2024

Friday, 19 April 2024

Notwithstanding a repeated history of strikes and counterstrikes as part of the shadow war between Israel and Iran, an attack from an aircraft on a diplomatic building is unusual

T.C.A. RAGHAVAN

Arunachal Pradesh is replete with unemployment, lack of roads and drinking water, poor literacy (four candidates are illiterate crorepatis) and negligible representation of women

SUDIPTA BHATTACHARJEE

The 1990s was a watershed era. A new entity called non-government organisation emerged at the grassroots level which redefined the nature of non-party political formations

HILAL AHMED

Last rites and rituals are the last to change. My conversations with ritual specialists reveal that some changes are taking place. We are exploring greener cremation systems

MINAKSHI DEWAN

An objective measure of the gap between Mr Modi’s word and deed when it comes to upholding constitutional values could be a reliable indicator of the nature of the prime minister’s guarantees

THE EDITORIAL BOARD

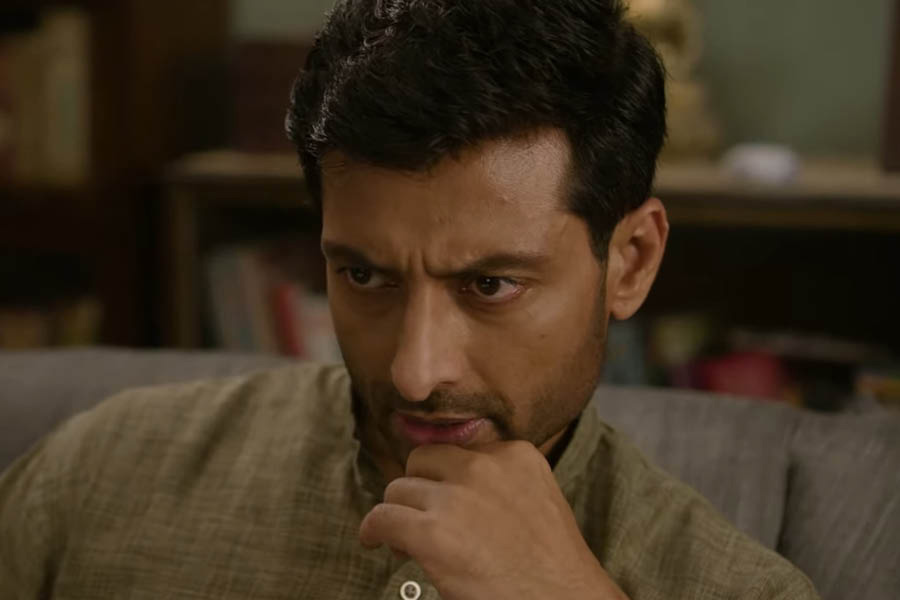

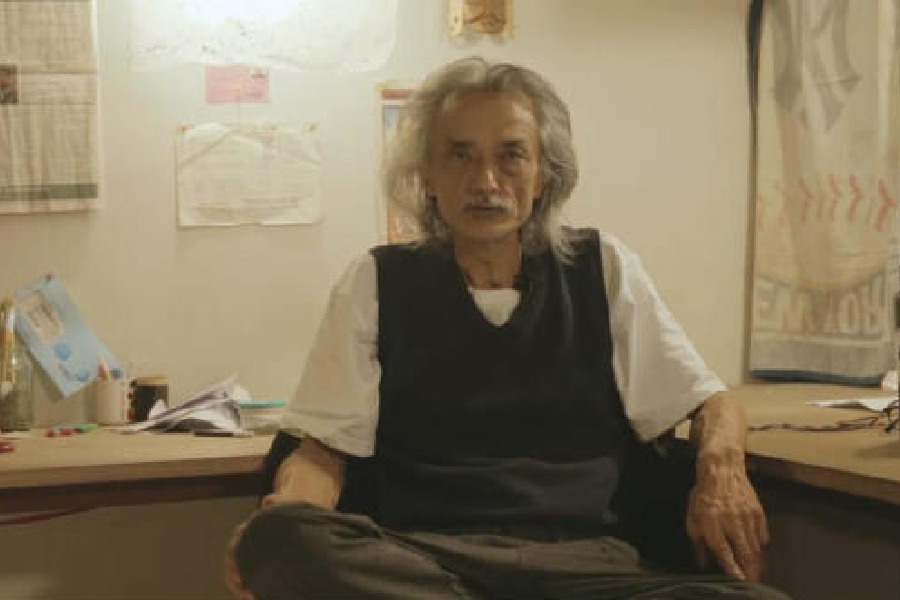

Malayalam cinema records its best month of the year so far, while Yodha and Swatantrya Veer Savarkar miss the mark