Wednesday, 15 May 2024

Wednesday, 15 May 2024

Wednesday, 15 May 2024

Wednesday, 15 May 2024

The Nandy Sisters had a ‘Heeramandi’ themed collab with Rani KoHEnur

The teaser of ‘Heartstopper’ Season 3 has a Billie Eilish’s Easter egg

Beat the summer heat with chef Kunal Kapur’s Guava Masala Mojito recipe

Grab Swiss Beauty’s summer skincare and makeup essentials now!

Mark your calendar for ‘Koi Aur Raasta’ at Gyan Mancha

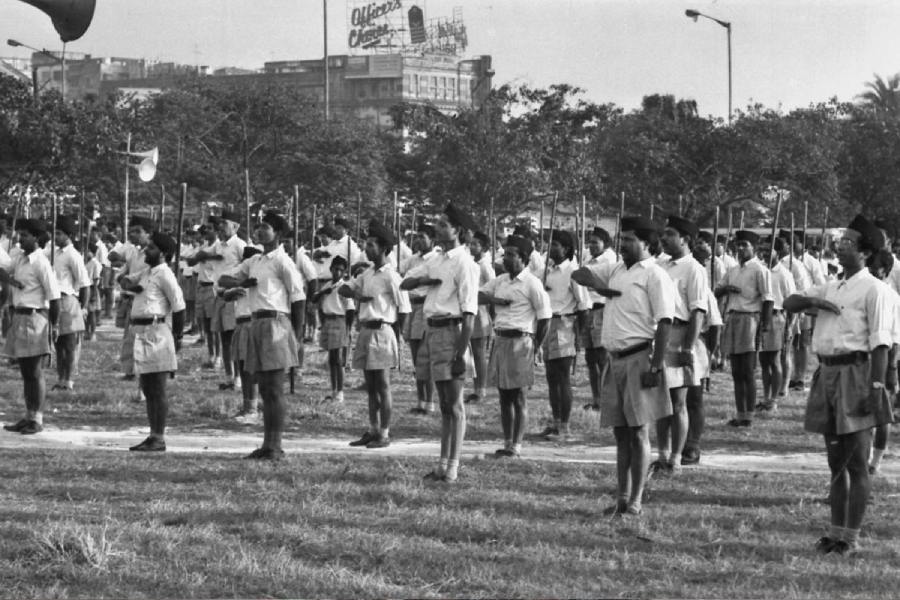

As another general election cycle continues, most parties promise development, but calculate their chances based on the identity of people likely to vote for them

ARGHYA SENGUPTA

Why do so many accidents occur? It is estimated that 70% of the accidents are caused on the power press machines, and in almost all the cases the workers had lost at least two fingers

NISHA SRIVASTAVA

Rather than zooming into this fleeting moment of two months, an imaginary zooming out might allow us to see these elections and their ramifications in the context of the recent past and the near future

RUCHIR JOSHI

The first Indian recording made commercially in Calcutta took place on Nov 8, 1902. The singers were two nautch girls, Sashi Mukhi & Feni Bala, from Amarendra Nath Dutta’s Classic Theatre

MOUSUMI ROY

Kejriwal’s political chutzpah is certain to energise the Opposition’s campaign & be an irritant to BJP. His presence assumes significance as AAP's strongholds are yet to go to the hustings

THE EDITORIAL BOARD

The comedy mystery series is slated to premiere on Hulu on August 27